In the Spotlight

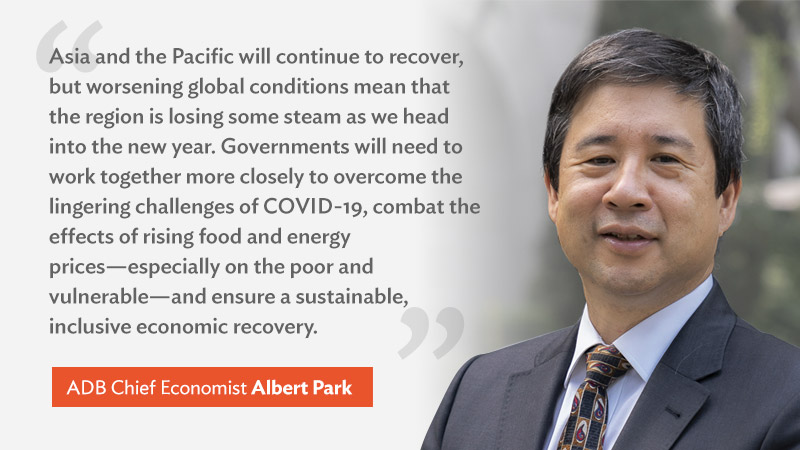

Asian Development Outlook (ADO) 2022 Supplement: Global Gloom Dims Asian Prospects

This supplement provides updated economic projections, revising growth forecasts for developing Asia down slightly from 4.3% to 4.2% in 2022 and from 4.9% to 4.6% in 2023.

Asia Bond Monitor – November 2022

This publication reviews recent developments in East Asian local currency (LCY) bond markets against a backdrop of deteriorating global financial conditions and provides an assessment of the outlook, risks, and policy options.

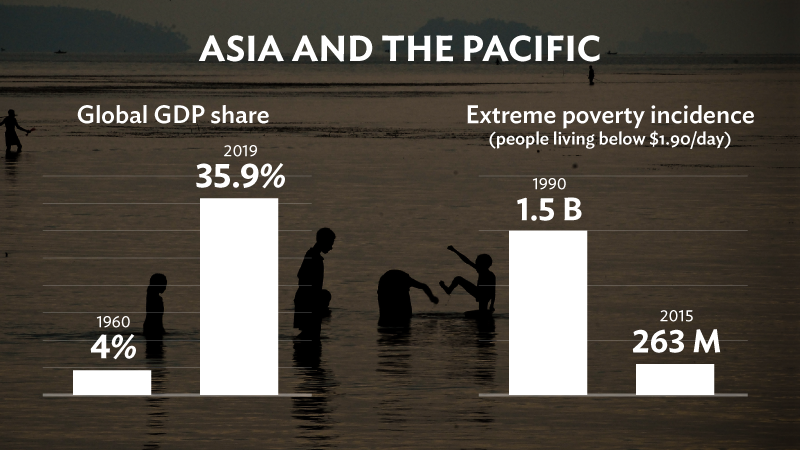

Key Indicators for Asia and the Pacific 2022

This publication provides updated statistics on a comprehensive set of economic, financial, social, and environmental measures as well as select indicators for the Sustainable Development Goals (SDGs).

Asian Economic Integration Report 2022: Advancing Digital Services Trade in Asia and the Pacific

This report explores how Asia and the Pacific can capitalize on growing opportunities in digital services through structural reforms and international cooperation.