Lending and Grant Modalities

ADB's wide range of modalities meet the diverse and evolving needs of its developing member countries (DMCs).

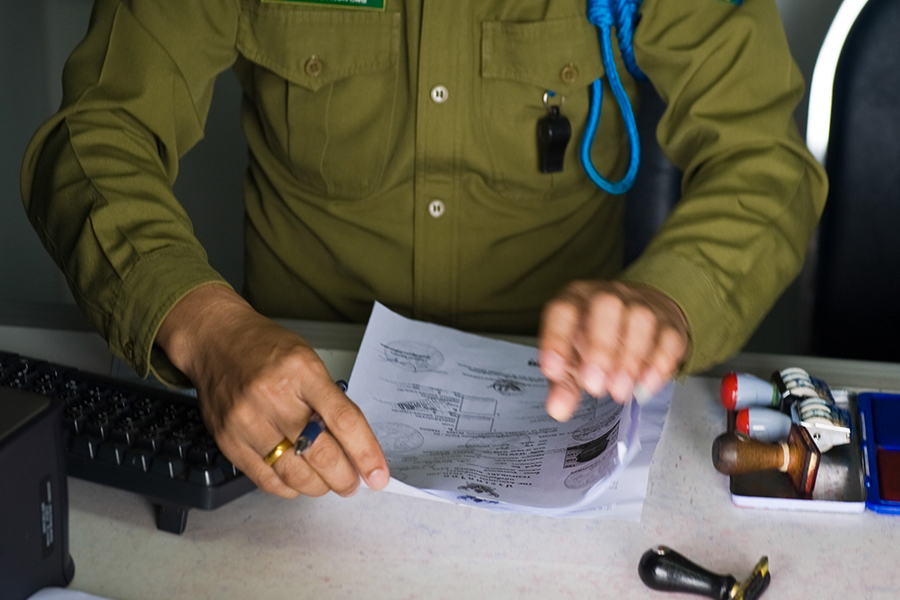

pay for goods, works, and services related to specific projects. Investment lending includes the project loan, sector loan, financial intermediation loan, emergency assistance loan, and multitranche financing facility.

provides general budget support to borrowers, helping countries facing a financing gap in their annual budget. PBL is disbursed only when the borrower completes policy reforms or actions that have been agreed with ADB.

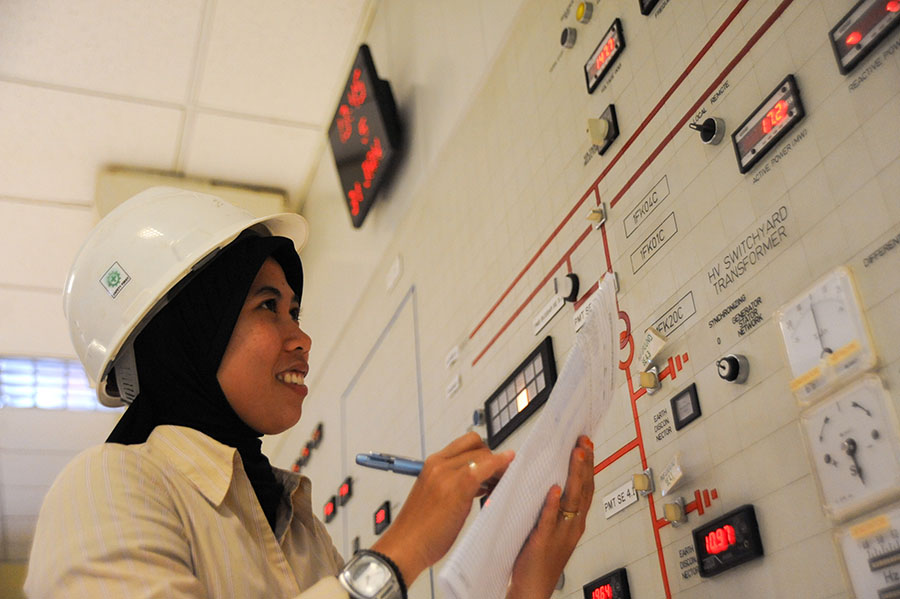

focuses on the positive change ADB’s support brings to beneficiaries. This modality supports government-owned programs through a performance-based form of financing.

include project readiness financing, the small expenditure financing facility, PPP standby financing facility, and technical assistance.