In the Spotlight

-

Investor Presentation

The ADB Investor Presentation provides an overview of the Asian Development Bank, its operations, and other information relevant to prospective investors.

-

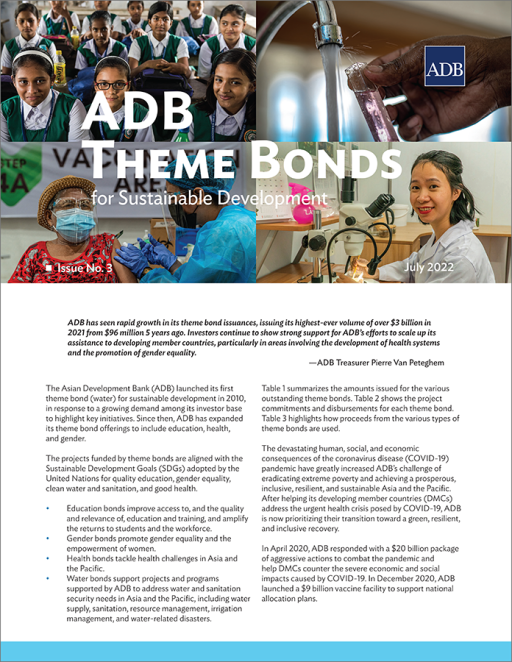

ADB Theme Bonds for Sustainable Development

This edition highlights the rapid growth of ADB’s theme bond issuances, which raised more than $3 billion during 2021 to support sustainable development initiatives in Asia and the Pacific.

-

Q&A: Jonathan Grosvenor on Mobilizing Capital for Asia’s Development through Local Currency Bonds

ADB Assistant Treasurer Jonathan Grosvenor shares ADB’s plans for issuing local currency bonds in its developing member countries, and how this can help promote local capital market development.

-

The Blue SEA Finance Hub

The Blue SEA Finance Hub (BSFH) will serve as an “institutional base to proactively grow the Blue Economy in ASEAN” with the involvement of several other ADB units as well as external partners such as the United Nations Development Programme (UNDP).